How Much Can I Contribute to Tax Advantaged Accounts?

7/9/24

How much can I contribute to tax-advantaged accounts in 2024? There are several tax-advantaged accounts including:

- 401(k): $23,000 pre-tax, but $69,000 to the entire 401(k). The difference can include after-tax contributions that can potentially be rolled to a Roth IRA. For dual income families, these values apply to each spouse individually.

- Health Savings Account: $4,150 individuals; $8,300 families. This is a great one and a high priority to fund since it can completely avoid all taxation and can typically be invested in stocks. Strategically, it’s more of a super-advantaged retirement account than a health reimbursement account.

- Roth IRA: $7,000 with potential income restrictions and workarounds

- Dependent Care Flexible Spending Account: $5,000. This is a tax-efficient way to pay for a child’s daycare.

Participation in these programs can dramatically reduce your taxes. Some allow larger contributions for those aged 50+.

Historical Market Returns

7/2/24

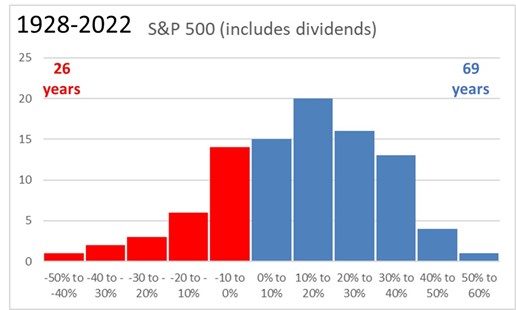

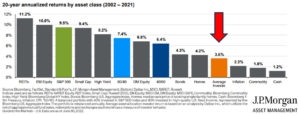

Historical market returns are important to ensure investors have reasonable expectations of the future. The S&P 500 (a common gauge of the US stock market) returned an average compounded return of 9.6% from 1928 through 2022, including dividends. However, stock returns can vary dramatically from one year to the next. The plot below shows the frequency of returns. The S&P 500 has had approximately 3 positive years for every down year.

Recency Bias

6/25/24

Behavioral finance bias refers to how psychological biases influence financial decisions. One common behavioral finance bias is recency bias. If a particular stock (consider NVIDIA or meme stocks) has been performing well over the last few weeks or months, someone affected by recency bias might assume that the trend will continue and make investment decisions accordingly, without taking into account other relevant factors. To counter recency bias, it’s important to adopt a more comprehensive and balanced approach to decision-making. It’s best to consider historical data, long-term trends, and fundamental factors that drive financial markets, rather than being swayed solely by recent trends.

Beta

6/18/24

Beta is a measure of a stock or investment portfolio’s sensitivity to market movements. It helps assess the investment’s risk in relation to the broader market.

Beta is expressed as a numeric value. A beta of 1 indicates that the investment tends to move in line with the market. A beta greater than 1 suggests the investment is more volatile than the market, while a beta less than 1 implies lower volatility. If a stock has a beta of 1.2, it’s expected to be 20% more volatile than the market. Conversely, a stock with a beta of 0.8 should be 20% less volatile. High-beta stocks are riskier but may offer higher returns, while low-beta stocks are less risky but may have lower returns.

Beta has limitations, as it only considers historical price movements and doesn’t capture all types of risk, such as company-specific events.

Target Date Funds

6/11/24

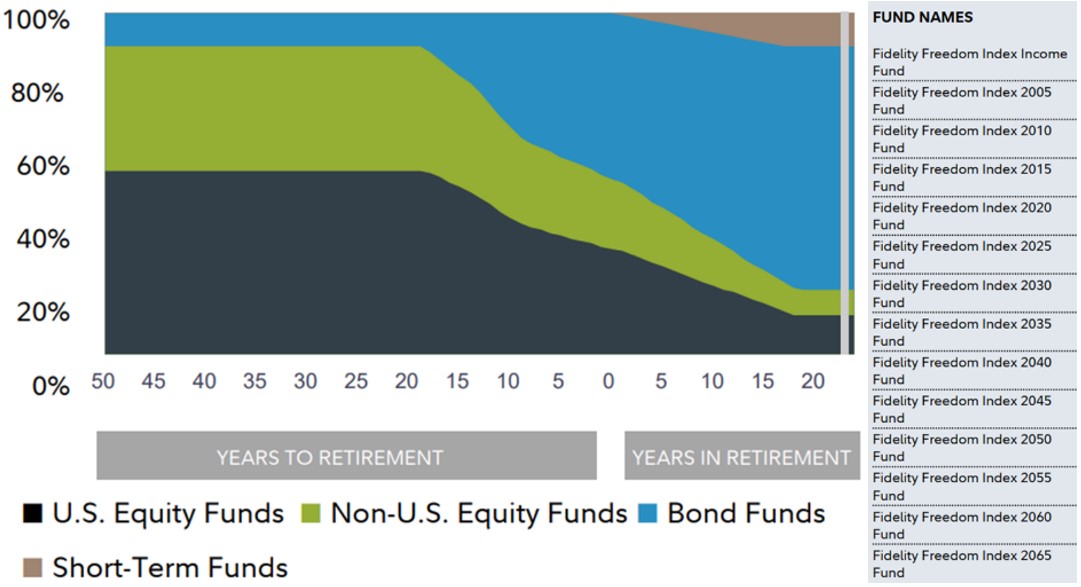

Target date funds have become very popular in retirement plans, and rightfully so. They often provide maximum diversification and convenience. Investors can simply choose the one with a name closest to their expected retirement date and obtain an entire investment portfolio in a single fund.

While target date funds have drawbacks, particularly around tax efficiency, they provide a solid portfolio for a typical investor. Fund design varies among the brokerages, but they typically have common qualities: use of the broadest, low-cost funds; proportional US/international stock exposure; high stock allocation in early years shifting to a more conservative portfolio over time.

Auto Policy Coverage

6/4/24

Nearly all of us have auto insurance, but not all of us understand it. Liability covers costs if you’re responsible for an accident, including medical bills and property damage for the other party. You may be responsible for damage beyond these limits.

A split policy may have 3 numbers: 30k/60k/25k (Texas min coverage)

- $30k of coverage for injuries per person

- $60k of coverage for injuries per accident

- $25k of coverage for property damage

A combined policy has 1 number which combines all bodily injury and property damage.

Consider the cost of medical treatment and the costs of new vehicles today. Then decide whether your liability coverage is appropriate.

Tactical Asset Allocation

5/28/24

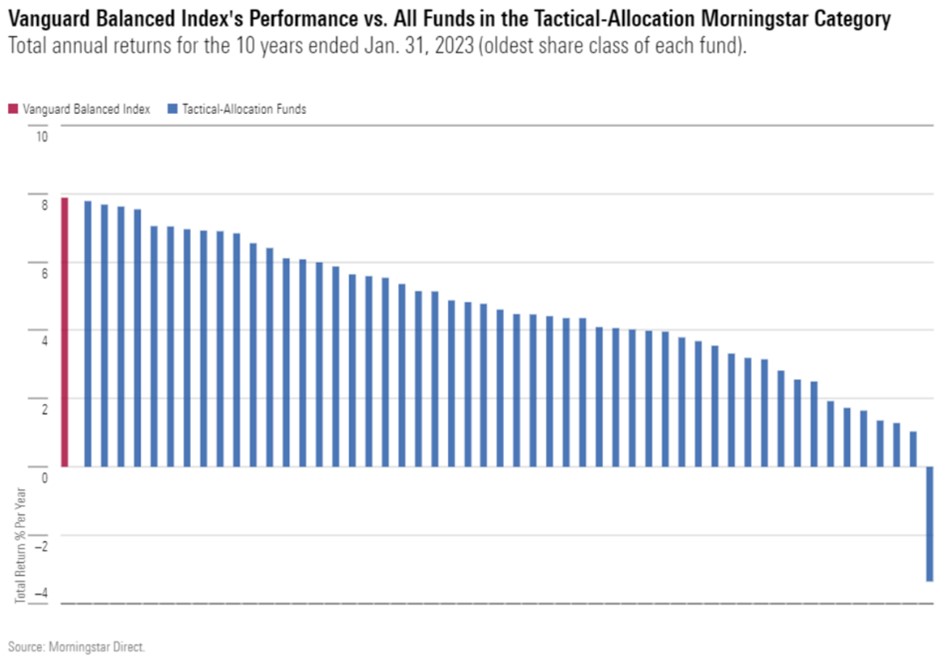

Tactical asset allocation is an active management portfolio strategy that shifts the percentage of assets held in various categories to take advantage of market pricing anomalies or strong market sectors. Example: an investor or fund may over/underweight portions of the portfolio if they think tech stocks will overperform or energy stocks will underperform in the future.

But can one effectively predict future under/overperforming segments to make this strategy work? According to Morningstar’s research, tactical allocation strategies haven’t worked well in the past with 52 of 52 tactical allocation funds underperforming over 10 years.

Bond Funds vs Individual Bonds

5/21/24

Most investors opt to own bond funds rather than individual bonds. A bond fund is a diversified collection of individual bonds, often with varying yields and duration. These funds use the generated revenue to purchase additional short, medium, or long-term bonds and generally maintain the bond profile. This technique diversifies risks associated with purchasing individual bonds. Bond funds are typically very large and have very good liquidity.

Individual bonds can be very useful when planning for a singular event. Planning to buy an expensive boat in 2 years, or want money set aside for a child’s college tuition or wedding? Individual bonds allow you to lock in a rate with a pre-defined term to meet future cash needs. This bond strategy doesn’t have a resale/market component, so it’s not impacted by interest rates if you hold it until maturity.

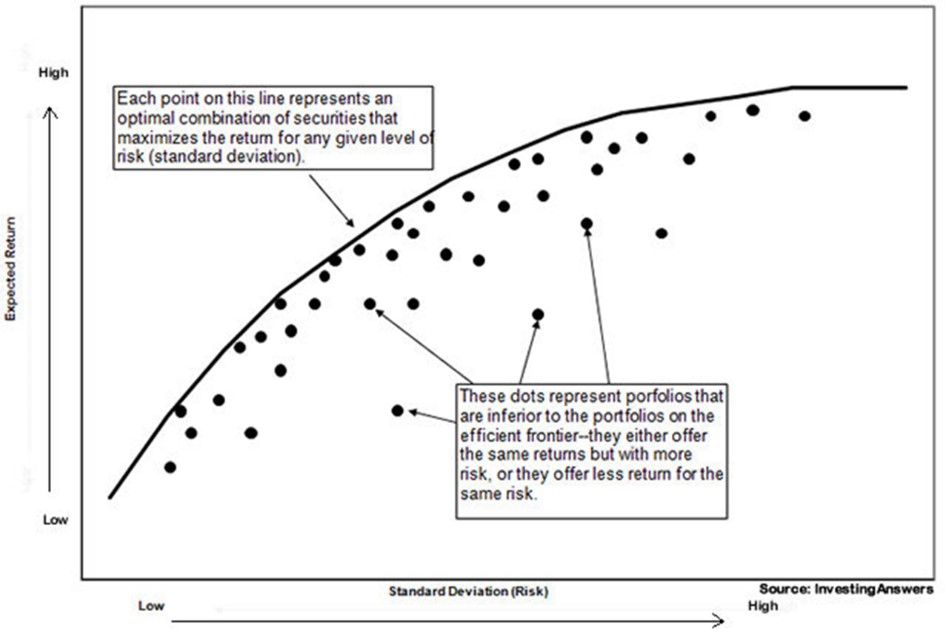

The Efficient Frontier

5/14/24

Nobel Prize winner Harry Markowitz developed the Efficient Frontier theory. It is considered to be the cornerstone of modern portfolio theory. The graphic below explains the concept.

4% Rule Applicability

5/7/24

The “4% Rule” suggests that withdrawing 4% of your initial retirement portfolio balance annually, adjusted for inflation, should provide a sustainable income for at least 30 years. 4% was the largest withdrawal amount lasting throughout a 30-year retirement in William Bengen’s research. It worked for the worst historical case.

Later research by Micheal Kitces showed that in 2/3rd of cases dating back to 1870, the retiree would finish a 30-yr retirement period with more than double their starting principle if they followed the 4% rule.

Bengen didn’t intend his 4% SAFEMAX to become the 4% rule. The median successful withdrawal rate is closer to 6.5%. Today there are better ways to determine how much to save for a secure retirement.

Treasury Bills, Notes, and Bonds

4/30/24

Treasury Bills (T-bills), Treasury Notes (T-notes), and Treasury Bonds (T-bonds) are all types of debt securities issued by the U.S. Department of the Treasury to raise funds for government operations.

- Treasury Bills (T-bills): short-term debt securities with maturities typically ranging from a few days to one year. They are sold at a discount to their face value, and investors receive the face value at maturity, effectively earning interest as the difference.

- Treasury Notes (T-notes): intermediate-term maturities, usually ranging from 2 to 10 years. They pay a fixed interest rate (coupon) every six months until maturity, in addition to the face value returned at maturity.

- Treasury Bonds (T-bonds): maturities typically ranging from 10 to 30 years. Like T-notes, they pay fixed interest every six months, but their longer maturity means they provide more risk/reward.

Treasury securities are considered among the safest investments globally because they are backed by the full faith and credit of the U.S. government.

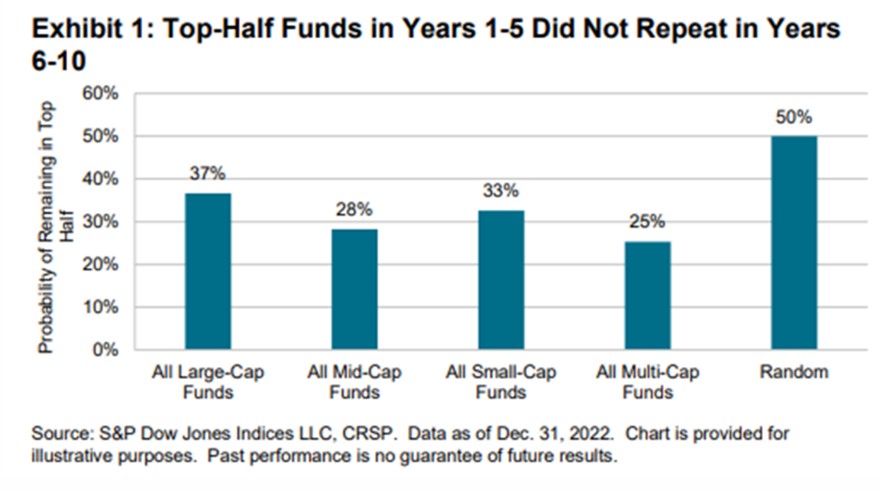

S&P Global Persistence Score

4/23/24

Relatively few actively managed funds outperform passive indexes over longer time periods. However, among funds that do outperform, how can we tell whether it is the product of skill or merely the result of good luck? This is the exact question S&P Global’s Persistence Scorecard addresses. They suggest that results produced by genuine skill are likely to persist while those due to luck are unlikely to persist.

Their year-end 2022 report “finds little evidence of persistent active management success, despite considering a variety of metrics and lookback periods. Exhibit 1 illustrates the general point, using 10 years of return data for U.S. equity managers.” In fact, past performance seemed to be less predictive than random luck.

S&P Global’s SPIVA Scorecard

4/16/24

S&P Global’s SPIVA Scorecard measures actively managed funds against their index benchmarks worldwide. They offer scorecards for Australia, Canada, Europe, India, Japan, Latin America, the Middle East, South Africa, and the United States. The SPIVA research tells us that relatively few active managers outperform passive managers over any given time period. The odds of actively managed funds outperforming tend to drop with longer time periods.

The primary reason: actively managed funds have higher fees (expense ratios), and those fees erode investor returns. Fees matter!

Health Savings Accounts

4/9/24

A Health Savings Account (HSA) is a tax-advantaged investment account designed for medical expenses. It offers quadruple tax-free benefits: tax-deductible contributions, tax-free growth, tax-free withdrawals, and potential FICA tax avoidance. HSAs are the most tax-advantaged account, and therefore one of the most powerful. Funding an HSA is generally ranked second in funding priority, only after getting an employer 401(k) match. For a family in the 22% tax bracket funding an HSA can reduce federal taxes by up to $2,460/yr.

HSAs are only available to those participating in a high deductible medical plan. Despite a common belief to the contrary, high deductible plans typically result in substantial savings relative to traditional low deductible plans.

To make maximum use of the HSA’s growth benefits one can use it as a supercharged retirement account. Withdrawals must be for qualified medical expenses, but do not have to be in the year of the expense. Receipts/EOBs can be saved to justify withdrawals decades later in retirement when funds are needed. This strategy gives HSAs maximum time to grow completely tax-free.

The Psychology of Money

4/2/24

“The Psychology of Money” by Morgan Housel is an incredible book that can transform the way you think about money. Money is a very emotional topic, and we all have psychological behaviors regarding money. Our behaviors around money are often based on our experiences and since life experiences can vary dramatically, so do our views and behaviors regarding money.

The book is certainly a worthwhile read for all but might be even more valuable for couples with differing money views. The book is a collection of money truths that bring awareness to many things we take for granted. It’s thought provoking, a genuinely interesting read, and can lead to valuable discussion and understanding.

Gift Taxes

3/26/24

Do I have to pay taxes on gifts received? No. Gift taxes, if applicable, are always the responsibility of the donor, not the donee.

Gift taxes by the donor are rarely applicable due to annual and lifetime exclusions. A donor may give gifts, transfer tax-free, up to $18,000 per donee per year (2024). This exemption is doubled if gifting from a couple or to a couple ($18k from/to each person). Any gifts above the yearly exemption are subtracted from the lifetime exemption, currently $13,610,000 per person. Gift taxes by the donor are applicable only after this $13.61 million exemption is exhausted.

Corporate Profits

3/19/24

Companies generate profits, and those profits ultimately flow to the owners. A well-known chemical company reported $6.59 billion operating EBIT (earnings before interest and taxes) and 37,800 employees in their 2022 annual report.

$6,590,000,000/37,800 = $174,339 operating EBIT/employee

That is a significant EBIT per employee. If an employee has similar compensation (salary + benefits), one could consider equal parts of this employee’s contributions going to compensation and to ownership. This may not seem fair to some, but it’s our economic system. Rather than debate or complain, let’s act strategically.

There’s a saying, “if you can’t beat them, join them” and employees can join them. By participating in 401(k) and other investment opportunities, employees can slowly but steadily accumulate ownership of public companies and reap profits that flow to ownership. This is the simple key to building wealth.

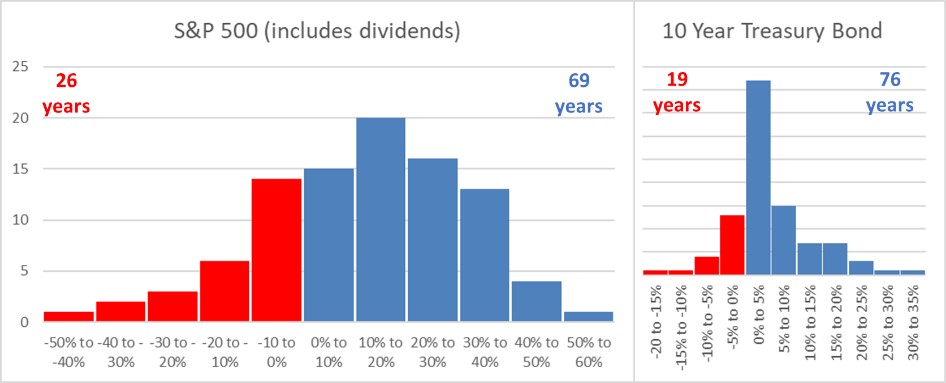

Historical Returns of Stocks and Bonds

3/12/24

What are historical stock and bond returns? These are plots of the S&P 500 and 10-Year Treasury Bonds 1928-2022. The S&P 500 averaged 9.6%/yr with a 19.5% standard deviation. 10-year bonds averaged 4.6%/yr with an 8.0% standard deviation. Stocks had higher growth. Bonds were more predictable. Both play a role in constructing a well-balanced, diversified portfolio.

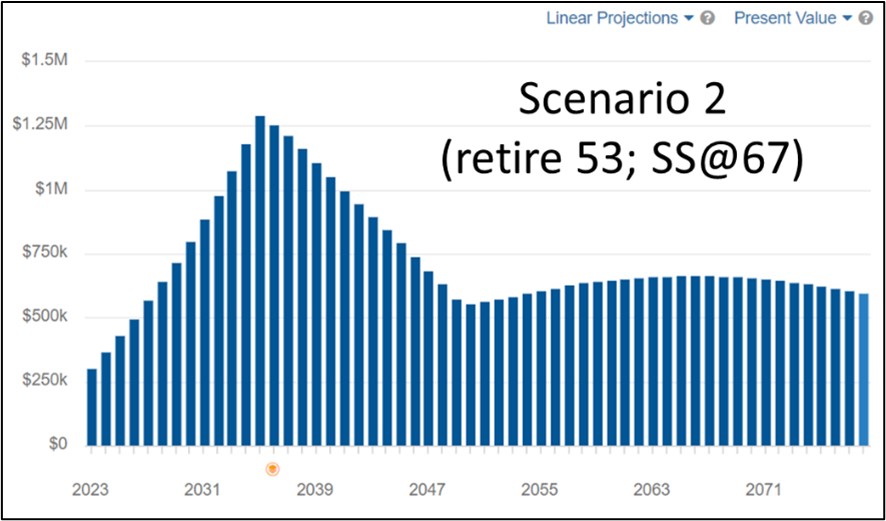

How Much Money Do I Need for Retirement

3/5/24

How much money do I need for retirement? The answer is really a personal choice. However, keep in mind that many expenses you have today may disappear. If you have kids, they’ll likely be out of the house. Daycare, food, clothes, activities, car expenses, etc. related to your kids may be gone. Mortgages may be paid off. Work related expenses disappear. As your spending decreases, taxes can drop dramatically (yay marginal rates). 7.65% FICA taxes are gone.

There are several rules of thumb on the internet suggesting an appropriate retirement nest egg, but they vary dramatically and overlook the most important aspect – individual circumstances. Financial planning is the most reliable way to quantify your future needs. In addition, financial planning ensures you reach your goals efficiently.

Financial Planning Software (eMoney)

2/27/24

Financial planning software has become a valuable tool for financial planners to model financial scenarios. Scientific Financial utilizes eMoney to organize a client’s financial assets and develop financial plans. eMoney uses a cash flow model to evaluate income, expenses, investment returns, tax liability, etc. on a year-by-year basis. It can also incorporate uncertainty with its Monte Carlo capabilities.

Financial planning software does not accomplish the most valuable part of financial planning – identifying opportunities. That value is dictated by the advisor’s knowledge. However, financial planning software does allow for the exploration and quantification of potential scenarios. This can be very valuable for a client to understand tradeoffs before selecting an action plan that best fits their values and preferred future life.

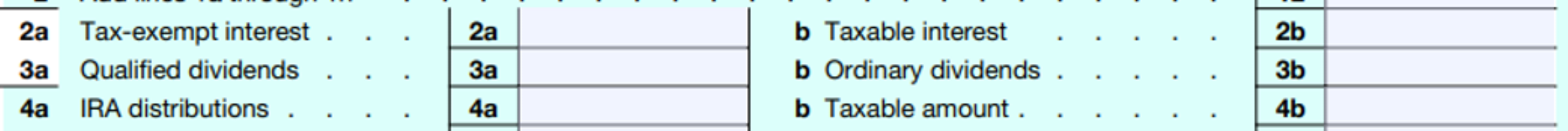

Commonly Missed Tax Reduction – Qualified Dividends

2/20/24

Possibly the most missed tax reduction relates to qualified dividends, 3a on the 1040. Tax software and financial statements often lead the taxpayer to leave box 3a blank. The IRS also shares blame as the 1040 form is misleading. Ordinary dividends (3b) are the total of all dividends reported on a 1099-DIV form. Qualified dividends (3a) are all or a portion of the ordinary dividends. They’re reported in box 1a on Form 1099-DIV. Qualified dividends are taxed at capital gains rates (often 15%). Non-qualified dividends (box 3b – box 3a) are taxed as ordinary income (often 22-24% marginal rate). For most investors, the vast majority of dividends are qualified dividends so be sure to report them in box 3a to ensure you pay the lower tax rate.

Don’t donate to Uncle Sam by leaving box 3a blank.

Asset Location

2/13/24

You may have an appropriately balanced investment portfolio, but have you considered asset location? Asset location focuses on where you hold particular investments. Roth IRAs are best suited for high growth assets (stocks). A pre-tax 401(k) is well-suited for lower growth assets (bonds) since this account will incur future taxes. The entirety will be taxed as ordinary income, not capital gains. In taxable accounts, consider investments with lower tax implications, like tax-efficient index funds.

The total stock/bond portfolio remains unchanged, but assets can be thoughtfully placed in accounts which will minimize your lifetime tax bill. Be strategic and avoid paying extra money to Uncle Sam.

Will I Pay Estate Taxes?

2/6/24

Will I/my parents pay federal estate taxes? Estate taxes are often misunderstood among the public. The 2024 federal estate tax exemption is $13.61 million per person. That’s $27.22 million for a couple. Essentially that means when the second to die of couple passes assets to the next generation, estate taxes only apply to the amount above $27.22 million. In 2020, <0.1% of people paid federal estate taxes. Heirs who receive an inheritance pay no taxes. The federal estate tax is pretty forgiving.

State estate taxes are a mixed bag. Oregon has the lowest exemption at $1 million per person. Most states (33 including Texas and Michigan) have no estate tax.

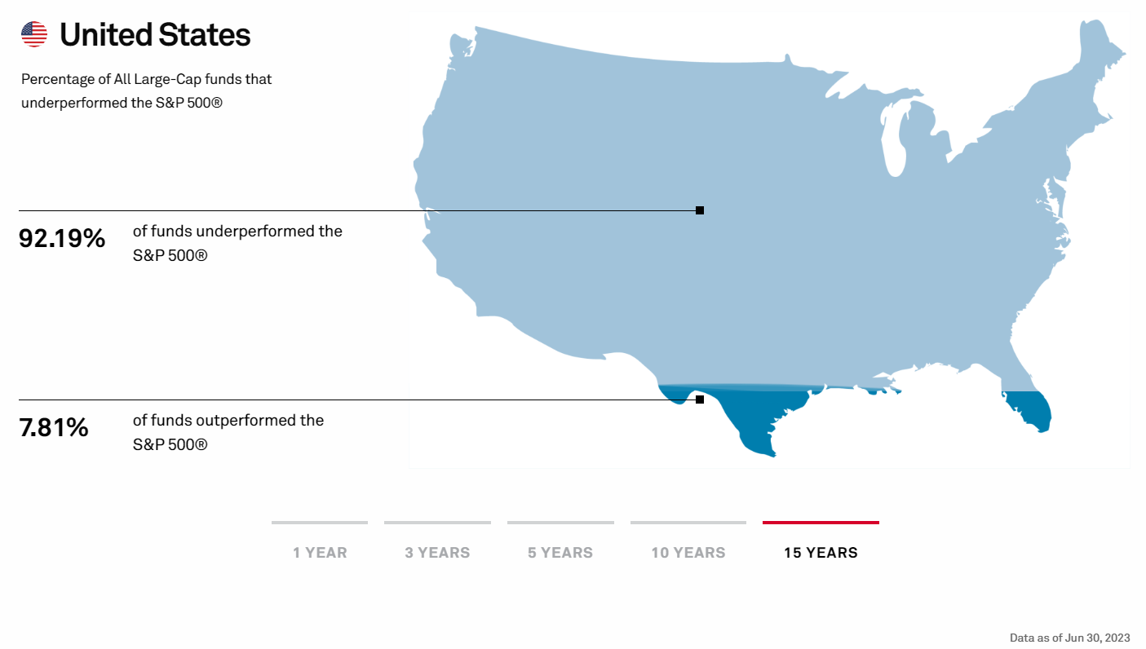

Index Funds vs Active Management

1/30/24

Index funds aim to replicate the performance of a specific market index, like the S&P 500, with very low fees. They provide broad market exposure. On the other hand, active management involves fund managers individually selecting investments in an attempt to outperform the market. While some active funds succeed, the vast majority underperform over longer time periods.

SPIVA monitors actively managed funds against their (proper) benchmark and provides scorecards to help investors understand returns of index funds vs actively managed funds. (Spoiler: about 92% of large cap funds underperformed the S&P 500 index 2008-2023)

Advantages of Investing Today

1/23/24

It’s easy to be pessimistic, but today we have significant investing advantages versus our parents.

- Low investing fees: In the 1970’s mutual funds often charged 1% or more expense ratios. Front-end or back-end loads of 5% were not uncommon. Today investors can get funds with fees below 0.1%.

- Accessibility: Today we have computers. That’s increased our options. The creation of an index fund with 4000+ companies is trivial and now very inexpensive. We can get incredible diversification and buy/sell ourselves. Many of our parents used a newspaper to check stock prices.

- Taxes: In 1979 the maximum personal tax rate was 70% and capital gains could be as high as 35%. Today, those max rates are 37% and 20%. You’re not likely in the top tax rate, but taxes are generally lower today.

- Tax-advantaged accounts: The 401(k) originated in 1978. The Roth IRA originated in 1997. And the most efficient investing account, the HSA, started in 2004. These 3 tax-advantaged accounts provide huge advantages to today’s investors.

Let’s be thankful for the investing advantages we have today. Many of our parents had to work until 60+. Today that’s not the case for the vast majority of us who engage in financial planning.

Medical Insurance Payment Terms

1/16/24

Health insurance has several important terms to understand. Premiums are paid on a regular basis and vary based on factors such as the type of plan, coverage level, etc. A health insurance deductible is the predetermined amount an individual must pay out of their own pocket before their insurance coverage begins to cover eligible medical expenses. Plans typically have co-insurance or co-pays. Co-insurance is the percentage of medical costs that an individual is responsible for paying after they’ve reached their deductible (ex: 20%). Co-pays are fixed amounts that individuals pay for specific medical services (ex: $100). The maximum out-of-pocket refers to the highest amount an individual is required to pay for covered medical expenses within a specific period, usually a year. This includes deductibles, co-insurance, and co-pays (but not premiums). The combination of these terms determines the value of the insurance, and the relative importance can vary by family.

Market Timing

1/09/24

Market timing refers to the practice of trying to predict the future movements of financial markets, such as stocks or bonds, in order to buy or sell assets at what is believed to be the most advantageous time.

To successfully time the market an investor must make two correct decisions, when to buy and when to sell. Research has shown that investors are rarely successful at market timing. The market is moving upward much more often than downward so any period of time with money on the sidelines is likely to miss gains.

Scientific Financial does not encourage market timing. We agree with the saying “Time in the Market beats Timing the Market”.

Financial Checkup

1/02/24

A financial checkup can be the financial equivalent to a medical checkup. Many of us schedule annual physicals and blood work to provide expert advice on our health and identify concerns before they become major problems. There’s also a benefit of obtaining expert advice on our financial life and identifying concerns before they become major problems.

Financial checkups are not common in the financial planning industry. Comprehensive financial planning can seem expensive, and price can become a barrier to those who don’t yet fully appreciate the value of financial planning. Financial checkups provide a lower cost entry point to financial planning.

Scientific Financial offers financial checkups as a 90-minute meeting to explore your financial picture and identify opportunities for improvement. It’s not comprehensive financial planning, but it’s much better than no financial planning.

Behavior Finance Biases – Anchoring

12/26/23

Behavioral finance bias refers to how psychological biases influence financial decisions. One common behavioral finance bias is anchoring. If the stock of a company has fallen quickly in a short period of time, some investors may anchor on a recent high, believing the price drop provides the opportunity to buy the stock at a discount and that the stock price will return to the previous value.

What is a Bond Fund?

12/19/23

A bond fund is an investment vehicle that pools money from multiple investors to purchase a diversified portfolio of bonds. These funds can hold various types of bonds, including government, corporate, municipal, or other fixed-income securities. Bond mutual funds or Bond ETFs (Exchange-Traded Fund) are often used to fill the bond allocation of an investor’s portfolio, thus reducing the volatility of the portfolio. It’s important to note that the value of bond funds can fluctuate with changes in interest rates and credit quality, so they have their own set of considerations in a well-rounded investment strategy.

The largest market cap bond fund holds approximately 10,707 bonds (12/4/23) and is available as a mutual fund (VBTLX) or an ETF (BND).

Complexity for the Sake of Job Security

12/12/23

If a financial advisor does complex things that you don’t fully understand, it’s possible they’re creating complexity for the sake of job security. A good financial planner makes investing simple. They seek to increase your understanding. They earn dedicated clients through creating value, not complexity and dependence.

Investment portfolios should not be complex. Owning more than 7-8 funds is probably not a good thing. Most families should not be utilizing complex tax-loss harvesting or direct index strategies. Options, alternative investments, hedge funds, and venture capital investments rarely outperform the simplest investing strategies.

If you have a financial advisor utilizing complex investing strategies or you’ve been a DIY investor and your investments have gotten complex, you may want to seek a free, second opinion from a fiduciary, fee-only financial planner. Recall the proverb “A fool and his money are soon parted.” Good investing is very simple.

Insurance Marketplace Subsidies

12/05/23

The Healthcare Marketplace resulted from the Affordable Care Act. The law provides consumers with subsidies (“premium tax credits”) that lower costs for households with incomes between 100% and 400% of the federal poverty level. These subsidies can be substantial and reduce the “health insurance problem” for those who choose to retire early or work independently.

Example: A 42-year-old couple with 3 young kids in Texas, with $100k income, could receive a subsidy of approximately $1,285 per month (2023). This can cover the entire premium of some Bronze plans.

Takeaway: The healthcare marketplace can substantially help with health insurance for those looking to work independently or retire early. You don’t have to work until you’re 65 and Medicare eligible.

How Do Assets Pass Upon Death

11/28/23

How do assets pass upon death? Generally, there are 4 methods to transfer assets.

- Contract titling – some assets may have a transfer on death (TOD), joint tenants with rights of survivorship (JTWROS) or other titling to shift ownership upon a death.

- Designated beneficiary – insurance policies and investment accounts typically have beneficiary designations.

- Trust – a legal contract between the grantor and a trustee. The trustee holds assets transferred to the trust for certain specified beneficiaries. The terms of the trust dictate what will happen upon the death of the grantor.

- Will – controls only those assets not passed through the methods above. Wills pass through probate, a legal process to distribute the remainder of the deceased’s estate.

Housing Ratios

11/21/23

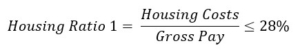

Housing ratios are financial metrics used to assess the affordability of housing costs in relation to your income. Two common ratios are:

Housing Ratio 1 (Basic): This ratio is the percentage of your gross monthly income that goes toward housing expenses: payment on principal, interest, taxes, and insurance (PITI). Generally, a HR1 of 28% or less qualifies for a conforming (best) rate mortgage.

Housing Ratio 2 (Broad): This ratio considers the percentage of your gross monthly income that goes toward all debt obligations. The HR2 benchmark generally used by lenders is ≤36% of gross pay.

![]()

One can use these ratios to avoid being “house-rich, cash-poor”.

529 Plans

11/14/23

A 529 plan is a tax-advantaged savings account designed to help you save for education expenses. These plans are typically sponsored by states and some states offer tax deductions/credits for contributing to their 529 plan. Earnings in a 529 plan grow tax-free, and withdrawals for qualified education expenses are also tax-free. It’s a useful tool to utilize in educational funding strategies.

Term vs Whole Life Insurance

11/7/23

Life insurance can seem complicated, but it doesn’t have to be. There are two main types of life insurance:

Term Life: Term is the life insurance most naturally think of. It pays a death benefit in the event of an untimely death. Term life insurance is valid for a term – potentially 1 year, 10 years, 30 years. It’s generally an inexpensive way to protect one’s family when additional money is needed to provide for future plans (pay mortgage, college tuition, child expenses, support a stay-at-home spouse, etc.). Term life insurance is typically not needed in retirement.

Whole Life: Whole life insurance is permanent life insurance combined with investments. These products are generally expensive, high commission products with surrender fees for early cancelation. Whole life insurance is generally not appropriate for a typical family. Whole life policies can make sense for businesses and estate planning for the wealthy.

Higher Taxes from Pre-Tax 401(k) or Post-Tax Roth IRA

10/31/23

Will I pay higher taxes investing pre-tax in a 401(k) or post-tax in a Roth IRA? Assuming tax rates are the same, you’ll receive the same amount of money in either case. If you invest pre-tax, you’ll invest a larger amount. It’ll grow larger over time and incur a larger tax bill. However, the take home amount will be the same as paying income tax upfront, starting with a smaller investment, and avoiding future taxes. If you start with 25% less seeds, you get 25% less apples.

The decision to invest pre-tax vs post-tax has more to do with providing tax-efficient future cash flow options and future tax rate changes (federal changes and your bracket changes).

Dividends

10/24/23

Dividends are payments made by a corporation to its shareholders as a distribution of profits. They are typically paid in cash. Companies that generate profits may choose to distribute a portion of those earnings to their shareholders as dividends. Dividends can provide investors with a regular income stream. A company’s dividend history can indicate financial stability and a commitment to returning value to shareholders.

It’s important to consider dividends when looking at historical stock prices. Established companies may have large dividends (Dow’s dividend yield is 5.57% as of 9/22/23). Rapidly growing companies may have no dividends. Tesla, Amazon, and Alphabet/Google have no dividends in 2023. They prefer to reinvest those dollars internally rather than distributing cash to shareholders. Due to dividends a more established company may provide a higher investor return despite significantly less stock appreciation.

How Financial Advisors Charge

10/17/23

Financial advisors typically charge fees in a few common ways. One approach is an assets-under-management (AUM) fee, where a percentage of the total value of your investments managed by the advisor is charged. Another method is a flat fee, where you pay a fixed amount for specific financial services. Some advisors charge hourly fees based on the time they spend working with you. Additionally, there are commission-based fees where some advisors earn a percentage from the financial products they recommend.

Terms like fee-only and fee-based can help guide consumers but aren’t well understood. Some advisors transparently display fees on their websites (unfortunately most don’t). Many don’t appreciate the fees they pay under AUM and commission-based models since the fees are “hidden”.

Be empowered and know your fees. No advisor should ever be offended by explaining how they’re paid. If you don’t get a crystal-clear answer, that’s a bad sign. Be empowered. You’re in charge!

Estate Planning Documents

10/10/23

Estate planning documents allow you to manage your assets and wishes effectively. Key documents include:

- Will – Specifies asset distribution and appoints guardians for minor children.

- Durable Power of Attorney: Authorizes someone to make financial decisions if you’re incapacitated.

- Healthcare Power of Attorney: Allows a chosen individual to make medical decisions on your behalf.

- Living Will (Advance Healthcare Directive): States your medical treatment preferences in critical situations.

- HIPAA Authorization: Permits access to your medical information for designated individuals.

- Letter of Instruction: Provides guidance on funeral arrangements and your wishes to help guide those making decisions after your death. This is an informal document and not legally binding.

Items 1-5 are often included in a documents package provided by an estate lawyer. Dow’s benefit plan can pay 100% of these legal fees.

Behavior Gap

10/03/23

The behavior gap refers to the gap between an individual’s investment returns and the actual market returns. It often stems from emotional decision-making, like buying or selling investments based on fear or greed rather than a well-thought-out strategy.

Dow’s 401(k) Options

9/26/23

Dow’s 401(k) offers many attractive investment options. Fees are generally very low. Investment options are grouped into 3 tiers: Target Date Funds, Core Funds, and Additional Funds (as of 2023).

Target Date Funds are available in 5-year increments. BTC LifePath® 2045 is designed for someone retiring around 2045. These funds invest aggressively when the target date is far away and shift more conservatively over time.

Core Funds include broad-based index funds. Options include an S&P 500 index, a completion index (total US index excluding the S&P 500), an international index, and a bond index fund.

Additional Funds include specialized indexes and active mutual funds.

Wash Sales

9/19/23

A wash sale occurs when an investor sells a security at a loss and then repurchases the same or a substantially identical security within a short period, typically within 30 days. The IRS disallows the immediate recognition of the loss for tax purposes in wash sales. Instead, the disallowed loss is added to the basis of the repurchased security. Understanding wash sale rules is essential for optimizing tax strategies when managing investment positions. Seeking professional advice can ensure compliance and informed decision-making.

Retirement Accounts Before 59.5

9/12/23

Generally, you can’t access retirement accounts before age 59 ½ without incurring a 10% penalty. However, there are several ways to avoid the 10% penalty for those planning to retire before 59 ½.

- Rule of 55

- Roth Conversion Ladders

- Substantially Equal Periodic Payments (SEPP)

With proper planning, retirement accounts can be accessed whenever you need them, regardless of age.

What to Invest In? (Accounts)

9/05/23

The US tax code provides us with several tax advantaged ways to invest money. Proper use of tax-advantaged accounts can make a huge difference to your wealth. Below is one general priority guide to place your money. Your personal situation may shift the order. There’s also value in balancing accounts with different tax treatments. Consult a financial planner for personalized advice.

1. 401(k) – Up to the employer match

2. Pay off high interest credit cards (not an account but typically higher priority than investing)

3. Health Savings Account (HSA) – can be an extremely powerful retirement account

4. 401(k) Pretax beyond employer match

5. Roth IRA

6. 401(k) Post Tax Contributions (if available; mega-backdoor)

7. Taxable Accounts

I Bond Off Ramp

8/29/23

I Bonds were all the rage in 2021 and 2022, but you may want to consider selling them soon. The current rate is 3.38%, lower than the 4.15% in my American Express Savings Account.

I Bonds must be held for 12 full months and then there is a 3-month interest penalty on I Bonds held for less than 5 years. Get this wrong and you could lose 3 months of 6.48% interest, rather than the current 3.38%. A good strategy is to wait 3 months after the 6.48% rate has been completed, then redeem early in the next month. That way all the penalty will apply to the 3.38% rate. However, when your 6.48% rate ends/ended depends on the month you bought them. Some can sell now, but others may need to wait several months to ensure they only forfeit the 3.38% rate. Several online articles can be found to explain the nuance.

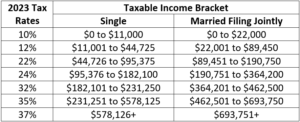

Marginal Tax Rates

8/22/23

Marginal tax rates apply to the last dollar of your income within a specific tax bracket. As your income increases, you might move into higher tax brackets, leading to a higher marginal tax rate for those additional earnings. It’s important to note that the marginal tax rate isn’t applied to your entire income, only the portion within that bracket. An understanding of marginal tax rates will help you reduce lifetime taxes and understand when pre-tax and post-tax investments are more efficient.

Target Date Funds

8/16/23

Target date funds are investment funds designed to simplify retirement planning. They automatically adjust the asset allocation mix (stocks, bonds, etc.) based on your target retirement year. When retirement is further away, the fund may have a higher stock allocation for potential growth. As you near retirement, the allocation shifts towards more conservative assets to preserve capital. Target date funds offer convenience, are generally well diversified, and often available with reasonable expense ratios. Asset location and tax efficiency should be considered when considering target date funds.

Expense Ratios

8/7/23

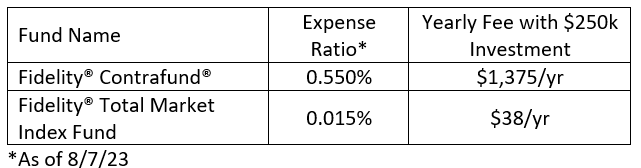

Mutual funds and ETFs have an expense ratio which is a management fee for the fund. You may not see the bill, but you’re paying it, and it may be significant. Below are examples of two popular Fidelity funds.